Current property market trends in Singapore

Singapore’s real estate market is projected to reach SGD 2696.69 billion ($2025.21 billion) by the end of 2024, with the residential sector leading at an estimated property value in Singapore amounting to SGD 2027.24 billion ($1522.46 billion). The market is expected to grow at a compound annual growth rate (CAGR) of 2.09% from 2024 to 2029, reaching SGD 2989.28 billion ($2244.95 billion) by the end of the period. Singapore’s market is witnessing significant growth, particularly in luxury condominium sales, driven by strong demand from foreign investors. Moreover, Singapore property market trends highly influence the pricing of real estate properties. Several key factors affect Singapore’s dynamic market, including:

- Government policies: Cooling measures and housing grants are implemented to maintain affordability.

- Economic growth: Property prices in Singapore are driven by the country’s economy. A strong economy boosts demand for real estate, while downturns may dampen prices.

- Location: With properties near MRT stations, top schools, shopping hubs, and the Central Business District (CBD) commanding higher values due to their accessibility and convenience.

- Land scarcity: Singapore, a city-state with just 728.3 square kilometers, exacerbates competition for limited space, driving prices upward.

- Demand and supply: Dynamics of supply and demand significantly impact property prices in Singapore; rising demand fueled by population growth, immigration, and investment sentiment often outpaces limited supply, pushing property prices higher.

Property prices by type

Real estate prices in Singapore vary depending on the type of residential property. Moreover, commercial properties are priced differently based on their use and location. Knowing the current market prices is essential when selling or buying properties in Singapore. Below are the property prices in Singapore.

HDB flats (public housing)

House prices in Singapore are primarily influenced by the Housing & Development Board (HDB), which is the public housing authority responsible for planning and developing the nation’s housing estates. In 2023, 77% of Singapore’s resident population resided in public housing provided by the Housing and Development Board (HDB). The HDB flat prices in Singapore vary depending on the town and flat type. Below are the property prices in Singapore for resale HDB flats.

| Location | 3-room HDB flat | 4-room HDB flat | 5-room HDB flat |

|---|---|---|---|

| Ang Mo Kio | SGD 410,000 ($307,910) | SGD 568,000 ($426,568) | SGD 920,000 ($690,920) |

| Bedok | SGD 400,000 ($300,400) | SGD 540,000 ($405,540) | SGD 738,400 ($554,538) |

| Bishan | SGD 520,000 ($390,520) | SGD 730,000 ($548,230) | SGD 989,900 ($743,415) |

| Jurong East | SGD 395,000 ($296,645) | SGD 510,000 ($383,010) | SGD 700,000 ($525,700) |

| Jurong West | SGD 378,000 ($283,878) | SGD 515,000 ($386,765) | SGD 600,000 ($450,600) |

| Tampines | SGD 458,000 ($343,958) | SGD 630,000 ($473,130) | SGD 730,000 ($548,230) |

| Woodland | SGD 425,000 ($319,175) | SGD 530,000 ($398,030) | SGD 640,000 ($480,640) |

Private condominiums

Private condominiums are non-landed, unsubsidized strata developments consisting of buildings or blocks with multiple residential units. They are individually owned properties, with owners having shared access to common areas within the building or complex. In Singapore, there is no restriction on the number of private apartments or condos foreigners can purchase and hold, allowing them to acquire as many as they wish. In the first half of 2024, property prices in Singapore for condominiums reached an average of SGD 1.95 million ($1.46 million). The detailed condo prices in Singapore are listed below.

| Region | Average price | Average price per square foot | Average price per square meter |

|---|---|---|---|

| Core Central Region (CCR) | SGD 9.84 million ($7.39 million) | SGD 2,202.76 ($1,654) | SGD 23,710 ($17,806) |

| Rest of Central Region (RCR) | SGD 5.81 million ($4.36 million) | SGD 2,128.73 ($1,599) | SGD 22,913 ($17,208) |

| Outside Central Region (OCR) | SGD 4.45 million ($3.34 million) | SGD 1,631.63 ($1,225) | SGD 17,562 ($13,189) |

Landed properties

Landed properties in Singapore, which comprise just 17.9% of private housing, are considered the most exclusive and expensive residential property. These properties come with high costs, not only due to their price but also for maintenance, which varies depending on the age of the house and additional features like lifts or swimming pools. In the first half of 2024, the Singapore private property prices for landed properties reached an average of SGD 5.37 million ($4.03 million). Below is a detailed table of the landed property prices in Singapore.

| Region | Average price | Average price per square foot | Average price per square meter |

|---|---|---|---|

| Core Central Region (CCR) | SGD 9.84 million ($7.39 million) | SGD 2,202.76 ($1,654) | SGD 23,710 ($17,806) |

| Rest of Central Region (RCR) | SGD 5.81 million ($4.36 million) | SGD 2,128.73 ($1,599) | SGD 22,913 ($17,208) |

| Outside Central Region (OCR) | SGD 4.45 million ($3.34 million) | SGD 1,631.63 ($1,225) | SGD 17,562 ($13,189) |

Commercial properties

Commercial real estate properties in Singapore are primarily used for business and investment purposes and are classified as retail, industrial, and commercial. The value of Singapore’s commercial real estate market is projected to reach SGD 667.25 billion ($501.1 billion) by the end of 2024, highlighting its substantial growth potential within the country’s property sector. Property prices in Singapore for commercial properties range from SGD 2 million ($1.5 million) to SGD 30 million ($22.53 million), depending on size and location. Moreover, monthly rent for commercial spaces can range from SGD 4,000 ($3,004) to SGD 13,000 ($9,763).

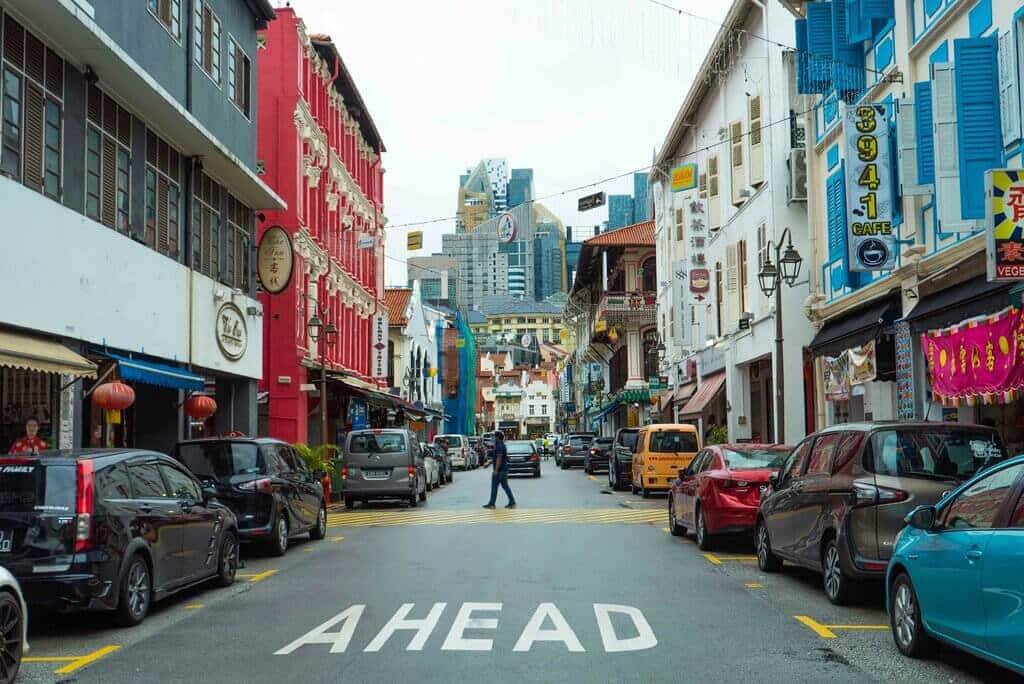

Singapore property prices by location

Property prices in Singapore are prominently influenced by location. Properties in central areas, such as Orchard Road, Marina Bay, and the central business district, are generally much more expensive due to their proximity to essential amenities, business hubs, and transportation networks. Conversely, properties in suburban or less accessible areas, like parts of the northern and western regions, tend to be more affordable due to lower demand, fewer amenities, and longer travel times to the city center. Below are the real estate prices in Singapore by location.

Prime districts (Districts 9, 10, 11)

Singapore’s Core Central Region (CCR) encompasses the city’s most prestigious areas, including districts 9, 10, and 11. This region is known for its luxurious properties, with many private residential units freehold. Key locations within the CCR include iconic neighborhoods such as Orchard, Somerset, River Valley, Tanglin, Bukit Timah, Holland, Newton, Novena, and Dunearn. Prime district property prices in Singapore are at a median of SGD 2.55 million ($1.92 million) for condominiums and SGD 8.4 million ($6.31 million) for landed properties. For instance, Singapore private property prices can range from SGD 5 million ($3.76 million) to SGD 15 million ($11.27 million) at Orchard and SGD 1.5 million ($1.13 million) to SGD 10 million ($7.51 million) at Somerset.

City fringe and suburban area

Singapore’s Outside Central Region (OCR) spans a vast portion of the island, offering more affordable property options than the Central regions. It includes districts such as Clementi and West Coast (District 5), Kembangan and Kaki Bukit (District 14), Bedok, Upper East Coast, and Bayshore (District 16), among many others. Property prices in Singapore around these regions are at a median of SGD 1.51 million ($1.14 million) for condominiums and SGD 3.87 million ($2.91 million) for landed properties. Moreover, resale HDB flats in these areas can cost SGD 385,000 ($289,135) to SGD 790,000 ($593,290) for Clementi, SGD 400,000 ($300,400) to SGD 738,400 ($554,538) for Bedok, and SGD 395,000 ($296,645) to SGD 700,000 ($525,700) in Jurong.

Newly emerging areas

Newly emerging areas for real estate in Singapore include Punggol, Jurong Lake District, and Woodlands, which are driven by large-scale government initiatives to create new business hubs and residential communities. Punggol is evolving into a digital district, attracting tech-related industries. At the same time, Jurong Lake District is set to become a second central business district, boosting demand for residential and commercial properties. Woodlands is also seeing development with a focus on residential and mixed-use properties and being integrated with the upcoming Cross-Border Rail Link.

Valuable insights and practical advice, distilled from years of expertise and real-world experience.

Frequently Asked Questions (FAQs)

What is the average price of an HDB flat in Singapore?

The average price of an HDB resale flat in Singapore is SGD 597,297 ($448,570).

Why are property prices in Singapore so high?

Property prices in Singapore are high due to limited land availability, strong demand from local and foreign buyers, a robust economy, and government measures that maintain market stability.

How much is a house in Singapore?

The average house price in Singapore for a landed residential property can cost SGD 5.37 million ($4.03 million). However, Singapore home prices are influenced mainly by type the property type and the property’s location.

Where can I find the cheapest HDB in Singapore?

The cheapest HDB flats in Singapore are typically found in non-mature estates like Yishun, Woodlands, or Jurong West, where demand is lower than in mature estates.

How much does the cheapest condo in Singapore cost?

The cheapest condos in Singapore generally cost around SGD 600,000 ($450,600) to SGD 800,000 ($600,800) for smaller units, such as one-bedroom apartments in suburban areas or older developments. However, pricing depends on factors such as location, size, and the development’s age.

Can foreigners buy a house in Singapore?

Yes, foreigners can buy private properties like condominiums in Singapore, but need government approval to purchase landed properties.

What is the most expensive house in Singapore?

The most expensive house in Singapore is the Good Class Bungalow (GCB), known for its large land size, exclusivity, and stringent zoning requirements.

Can I negotiate the property price in Singapore?

Yes, property prices in Singapore can often be negotiated, especially in a buyer’s market or for properties that have been on the market for an extended period.

What are the predictions for property prices in Singapore for the next 5 years?

Property prices in Singapore are expected to show moderate growth over the next five years, supported by continued population growth, robust demand, and infrastructure developments. However, the pace of price increases might be tempered by government cooling measures and evolving economic conditions. Moreover, the luxury property market will likely remain resilient due to strong interest from high-net-worth individuals.