Types of legal entities in Indonesia

Before starting a company in Indonesia, knowing the different types of legal entities and company forms is essential. Which type you need depends on the nature of the business and specific objectives. Foreigners can choose from the following types of companies:

- PT PMA (foreign-owned company): A PT PMA is suitable for foreign investors wanting total control of their business. PT PMA is the only legal entity in Indonesia that allows up to 100% foreign ownership.

- KPPA (representative office): The KPPA representative office is ideal for foreign investors and business owners in the early stages of expanding into Indonesia. Representative offices best suit non-sales activities and allow foreign businesses to test the Indonesian market without establishing commercial operations.

- KP3A (representative office for business trading): This representative office specifically for business trading does not allow sales and purchase activities. It can be set up in any part of Indonesia, unlike a KPPA.

- BUJKA (representative office for a construction company): This company type can engage in large-scale construction projects but only in collaboration with local PT companies in Indonesia. BUJKAs can participate in building projects without a specific construction license.

First, define which company entity you need before starting the registration of a company in Indonesia.

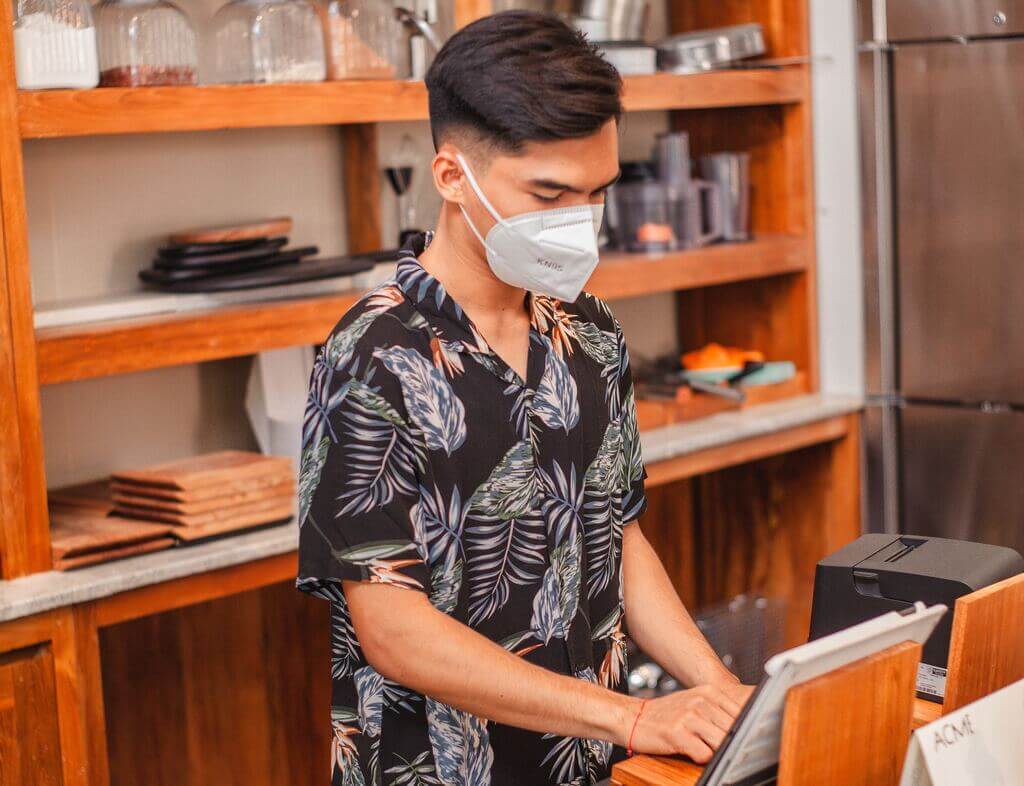

Valuable insights and practical advice, distilled from years of expertise and real-world experience.

How to register a company in Indonesia: 8-step guide

How and where to register a company in Indonesia depends on the type of company you want to establish. Most foreigners will establish a PT PMA, so we’ll explain how setting up a company in Indonesia as a foreigner works below.

Step 1: Register your PT PMA company name

The registration of your company in Indonesia starts with the approval of your PT PMA company name, which must consist of three words, be unique, and meet all the requirements.

Step 2: Deed of Incorporation

The Deed of Incorporation is one of Indonesia’s primary legal documents for company registration. This document must include the Article of Association and has to be legalized by a public notary.

Step 3: Approval of Legal Entity

After submitting the Deed of Incorporation by the notary, the Ministry of Law and Human Rights will approve the legal entity status. This is one of the most crucial steps for foreign company registration in Indonesia.

Step 4: Registration of Tax ID (NPWP)

Once the PT PMA is approved, the tax office will issue the Tax ID (NPWP) and Taxable Entrepreneur Confirmation (PKP). The NPWP is required to fulfill tax obligations, open an Indonesian bank account, and apply for business licenses in Indonesia.

Step 5: Domicile letter

The local district authority issues the Domicile Letter and requires you to show the location of your business. For that reason, all companies must have a physical office address. Does your company not yet have an address? You can then opt for a virtual office address.

Step 6: Company Registration Certificate (TDP)

TDP, or Tanda Daftar Perusahaan, is Indonesia’s Company Registration Certificate that proves the company’s establishment. It’s essential to store the Company Registration Certificate safely, like all the company registration documents, as you need it to open a bank account, apply for business licenses, and more.

Step 7: NIB application

The company will receive the NIB (Nomor Induk Berusaha), which is the business identification number. You will obtain the primary business license, location permit, and company registration number.

Step 8: Apply for other licenses

After setting up a company in Indonesia as a foreigner, you can apply for other business licenses, depending on the business sector. In some cases, you must obtain a business license before operation. Indonesia has several business licenses, such as commercial licenses, tourism licenses, and real estate licenses.

What are the benefits of a PT PMA?

A company registration in Indonesia comes with many benefits. These are the most essential benefits of starting a PT PMA company in Indonesia:

- It can be 100% owned by foreigners: Foreigners can start a business in Indonesia and make profits through a PT PMA, the only company type foreign nationals (WNA) can fully own.

- PT PMA can employ foreigners: The company can sponsor foreign employees and give them a work stay permit (Working KITAS).

- It has the right to buy freehold real estate: The PT PMA can buy freehold land and property, which is something foreigners can’t. Foreign-owned companies can also lease land or property. If a PT PMA wants to own property on leased land, it must apply for Hak Guna Bangunan (HGB).

- Apply for business licenses in Indonesia: It’s possible to obtain business licenses in Indonesia with a PT PMA to be active and operate in different sectors.

- Obtain a residency permit: The director and commissioner can apply for a temporary stay permit card, known as Investor KITAS, which allows them to reside in Indonesia for two years.

Requirements to register a company in Indonesia (PT PMA)

There are several requirements for a foreign company registration in Indonesia:

- Every PT PMA must have at least two shareholders: There must be at least two shareholders to start the registration of a company in Indonesia, which can be individuals or legal entities.

- There must be one director and one commissioner: A PT PMA must have one director and one commissioner.

- Valid passport for every shareholder: Individuals can only register a company in Indonesia with a valid passport. The Company Registration Certificate (TDP) is required if a legal entity becomes a shareholder in the Indonesian company.

- Paid-up capital amount: The paid-up capital is set at 25% of the minimum required investment of IDR 10 billion ($610,000), which is IDR 2.5 billion ($152,500). Foreign investors must transfer the paid-up capital to an Indonesian bank account. In some industries, shareholders can sign a Capital Statement Letter, where they pledge to invest money without ever transferring it, which means there is no requirement to invest money at the moment of the PT PMA registration.

How much does company registration Indonesia cost?

The cost of setting up a company in Indonesia varies between IDR 20 million ($1,220) and IDR 28 million ($1,708). The exact company registration cost in Indonesia mainly depends on the location and agency you use. Setting up a company in Indonesia usually takes six to ten weeks.

Need help registering your company in Indonesia?

Starting a business in Indonesia can be complex, but our expert team is here to assist you. Leave your name and email below, and we’ll guide you through the eight steps to successfully register your PT PMA. From understanding legal requirements to preparing documentation and navigating regulatory hurdles, we provide comprehensive support tailored to your needs. You can also email us directly at [email protected]. Start your business journey in Indonesia today!

Valuable insights and practical advice, distilled from years of expertise and real-world experience.

Frequently Asked Questions (FAQs)

How to register a company in Indonesia?

The registration of a company in Indonesia starts by choosing the correct legal entity, such as a PT PMA. Reserve your company name, draft the Articles of Association, obtain a domicile letter, and apply for a Tax ID (NPWP). Secure the Indonesian Business Identification Number (NIB) and, if necessary, obtain specific business licenses.

How do I check the company registration number in Indonesia?

To verify a company registration number in Indonesia, visit the Indonesian Ministry of Law and Human Rights website. Use the online verification tool by entering the company’s name or registration number to retrieve the company’s official details.

Is off-shore company registration in Indonesia possible?

Off-shore company registration in Indonesia is possible by working with a legal agency. The foreigner must sign a Power of Attorney for the legal agency to proceed with the off-shore company establishment in Indonesia. Do you want to register a company off-shore? Contact us at [email protected].

Where to register a company in Indonesia?

Companies in Indonesia are registered with the Indonesian Investment Coordinating Board (BKPM) and the Ministry of Law and Human Rights. The registration process can be initiated online through the Online Single Submission (OSS) system, followed by submitting the required documents to the respective government bodies. Owning property abroad can help foreigners register a company in Indonesia.

How to apply for an Indonesia business visa?

To apply for an Indonesian business visa, submit an application to the nearest Indonesian Embassy or Consulate in your country. Provide necessary documents like a valid passport, a letter of invitation from an Indonesian sponsor, and proof of sufficient funds. Once approved, the visa allows multiple entries with a maximum stay of 60 days per visit.

What is KITAS and how do I apply for it?

KITAS (Kartu Izin Tinggal Terbatas) is a limited-stay permit card for foreigners living in Indonesia. To apply, secure a sponsorship from an Indonesian company or individual. Submit the required documents, including a valid passport and sponsorship letter, to the Directorate General of Immigration. Once approved, the KITAS is valid for one year and can be extended. There are several KITAS types, such as Working KITAS and Investor KITAS.

Is online company registration in Indonesia possible?

Yes, online company registration in Indonesia is possible through the Online Single Submission (OSS) system. This platform streamlines the registration process, allowing investors to obtain the necessary permits and licenses digitally. Using the OSS system, foreign and local entrepreneurs can efficiently establish their businesses in Indonesia without needing multiple in-person visits to government offices.