Jakarta is the capital city of Indonesia and one of the fastest-growing cities in Southeast Asia. The city serves as an essential hub for trade, finance, and commerce, making it an attractive location for multinational corporations. Consequently, Jakarta has a high demand for office, retail, and residential space. The potential return on investment (ROI) and property rental yields in Jakarta are among the main reasons for considering purchasing property in the city.

Average property rental yields in Jakarta

The average rental yield of property in Jakarta is 6.15%, varying between 1.5% and 10.8%. These property rental yields make Jakarta an exciting city to invest in real estate, as the rental yields are, on average, higher than in most other Indonesian cities and regions. The tables below show the buying costs, monthly rent, and average rental yield for each Jakarta neighborhood.

South Jakarta

| Type | Buying cost | Monthly rent | Rental yield |

|---|---|---|---|

| Studio | $66,172 | $596 | 10.80% |

| 1-bedroom | $132,344 | $1,191 | 10.80% |

| 2-bedroom | $224,985 | $1,575 | 8.40% |

| 3-bedroom | $363,947 | $2,316 | 7.64% |

| 4-bedroom | $853,621 | $4,764 | 6.70% |

West Jakarta

| Type | Buying cost | Monthly rent | Rental yield |

|---|---|---|---|

| Studio | $39,703 | $193 | 5.83% |

| 1-Bedroom | $58,983 | $292 | 5.95% |

| 2-Bedroom | $76,098 | $331 | 5.22% |

| 3-Bedroom | $185,282 | $662 | 4.29% |

| 4+Bedroom | $324,884 | $744 | 2.75% |

North Jakarta

| Type | Buying cost | Monthly rent | Rental yield |

|---|---|---|---|

| Studio | $21,506 | $138 | 7.69% |

| 1-Bedroom | $59,555 | $248 | 5.00% |

| 2-Bedroom | $39,703 | $210 | 6.33% |

| 3-Bedroom | $165,415 | $551 | 4.00% |

| 4+Bedroom | $221,656 | $827 | 4.48% |

Central Jakarta

| Type | Buying cost | Monthly rent | Rental yield |

|---|---|---|---|

| Studio | $62,858 | $121 | 2.32% |

| 1-Bedroom | $69,474 | $110 | 1.90% |

| 2-Bedroom | $86,016 | $165 | 2.31% |

| 3-Bedroom | $198,498 | $248 | 1.50% |

| 4+Bedroom | $317,597 | $717 | 2.71% |

East Jakarta

| Type | Buying cost | Monthly rent | Rental yield |

|---|---|---|---|

| Studio | $34,406 | $83 | 2.88% |

| 1-Bedroom | $41,685 | $94 | 2.70% |

| 2-Bedroom | $39,045 | $96 | 3.04% |

| 3-Bedroom | $51,609 | $210 | 4.87% |

ROI for real estate in Jakarta

The average return on investment (ROI) for real estate in Jakarta can vary depending on various factors such as the property type, location, condition, and holding period. However, the average ROI for real estate in Jakarta is estimated to be around 8-10% per annum.

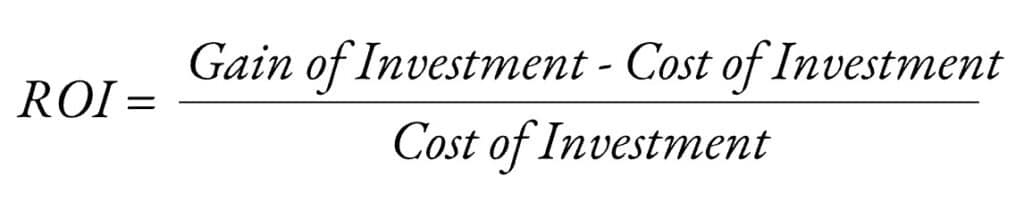

Calculate the ROI for your property

You can determine your investment’s (possible) profit or gain by calculating the ROI (Return on Investment). You can calculate this rate with the following formula:

For example, if you buy an apartment in Jakarta for IDR 167.7 million ($10,230) and sell it five years later for IDR 213.44 million ($13,020), the ROI is 27.27% over five years:

- The net profit is IDR 45.74 million ($2,790)

- The ROI is 27.27%

How much does property in Jakarta cost?

The table below shows an overview of the average property prices in Jakarta per square meter. Note that the cost varies depending on the property’s type, condition, size, location, and building materials. The prices are also subject to change based on market conditions and other factors.

| Property type | Price per square meter |

|---|---|

| Luxury apartment | IDR 50 million ($3,050) – IDR 150 million ($9,150) |

| Mid-range apartment | IDR 20 million ($1,220) – IDR 50 million ($3,050) |

| Landed house | IDR 10 million ($610) – IDR 50 million ($3,050) |

| Office space | IDR 20 million ($1,220) – IDR 70 million ($4,270) |

| Retail space | IDR 30 million ($1,830) – IDR 150 million ($9,150) |

How can foreigners invest in real estate in Jakarta?

Foreigners can invest and buy property in Jakarta through various methods due to restrictions on direct ownership. One common method is establishing a PT PMA (foreign-owned company), which allows foreigners to purchase property under the company’s name. This approach not only facilitates property acquisition but also enables business activities and obtaining residency permits. Another method is buying leasehold property, where foreigners can lease land for up to 80 years, providing long-term use without outright ownership.

Additionally, foreigners can acquire property under Hak Pakai (HP), which is a legal title that only permits the use of the property for the buyer’s residence. Lastly, some foreigners use Indonesian nominees, who legally own the property, while a separate agreement ensures the foreigner’s rights. Each method has unique requirements and legal implications, making it essential for foreigners to thoroughly understand and comply with Indonesian property laws.

Need help with property investment in Jakarta?

Looking to invest in property in Jakarta? Leave your name and email below, and our expert team will guide you through every step, from understanding legal requirements to finding high-ROI properties. Get personalized support to maximize your rental yields and ensure a successful investment. You can also directly email us at hello@ownpropertyabroad.com. Start your property investment journey in Jakarta today!

Frequently Asked Questions (FAQs)

Can foreigners buy property in Jakarta?

Foreigners can buy property in Jakarta through several methods, including buying through a PT PMA, buying Hak Pakai property, buying under a leasehold agreement, or with help from a local nominee. For property investment purposes, it’s best to purchase through a PT PMA.

What are the best areas in Jakarta to buy property?

The best areas to buy property in Jakarta include Kemang, Kuningan, Senayan, Menteng, Sudirman, Kebayoran Baru, and Pondok Indah. There is a high demand for properties in these areas, which makes them ideal locations for investment in Jakarta.

Is it smart to invest in property in Jakarta?

Investing in real estate property in Jakarta can be a smart move because the city offers high rental yields and returns. There is a strong demand for rental properties in Jakarta, making it easy to find tenants and achieve a high occupancy rate. This can make property investment in Jakarta highly profitable.